5 Money Lessons You Need to Learn from Lil Baby

Lil Baby has been pushing a consistent message lately which was emphasized through his music much last year and has given the culture a sense of progression in terms of the importance of financial literacy.

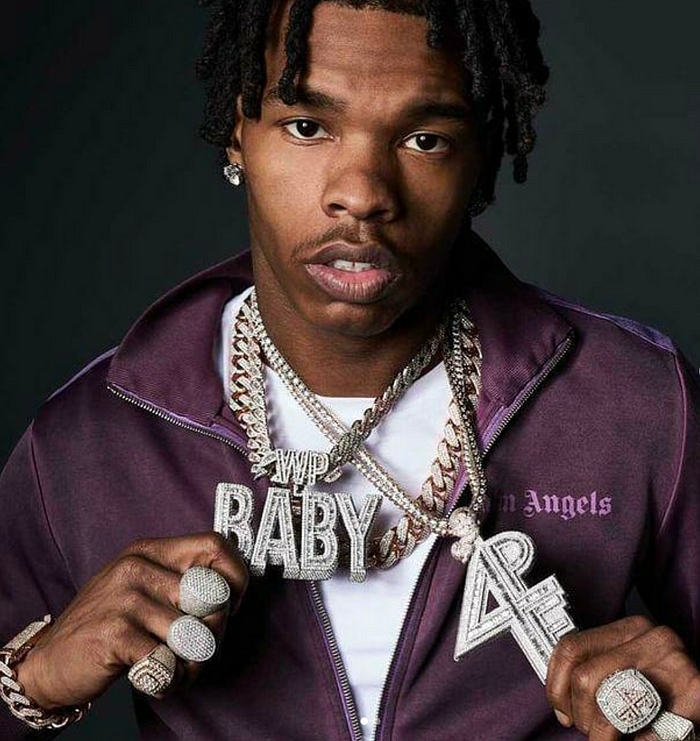

2020 was controversial, challenging, and surprising for most. There are those who have been able to continue their success or even begin and find new success in the midst of a nationwide pandemic that left tens of millions unemployed across the nation. Some have small windows of opportunity in their industry while others have created new markets all of their own due to the spur of creativity that is necessary to sustain a drought. One popular figure has managed to be of the latter group, pushing through and letting his creativity push him. That is Atlanta music artist Lil Baby.

Lil Baby had great success in 2020. He was the first artist to go double-platinum last year, with his sophomore album My Turn hitting 4 billion streams (Johnson, 2020). He also had his first Number 1 single with “The Bigger Picture,” a tribute to and outcry of black people’s struggle in America in the wake of George Floyd’s murder. Through his success, Lil Baby has continued to voice his views in many aspects. One topic that he spoke about lately that at first surprised many, but shouldn’t if you understand the artist and where he comes from, is on the topic of saving.

In a Q&A with Apple Music Beats 1, Lil Baby said the following on how he views getting money:

“…Now I have to make new dreams that I couldn’t even imagine. I gotta get a hundred mil. Now I just, that’s the new mark. I gotta get a hundred mil. … Five years at max. Not worth — but have. … Only thing I can count is the money I got. I don’t even count if I can sell these rings or sell this watch. … I save most of my money. I can’t buy a watch for 300 bands and then be like I got my 300 and my watch. My 300 gotta be in the bank.”

Here Lil Baby demonstrates a fundamental understanding of wealth that easily goes over many people’s heads due to perception, misconceptions, and even long standing myths that have come to be generally accepted. The topic of discussion related to wealth and your cash flow are two different things. Let’s just break down what exactly Lil Baby is saying.

I gotta get a hundred mil ($100 Million) five years at max. Not worth — but have. Here Lil Baby sets a clear accumulation goal of $100 million over the next five years at most. He also makes it clear that he understands that he could (or very well could not) be worth that $100 million, but it wouldn’t mean he has it on hand or that he could take and use at any time — that speaks to his liquidity. “Financial liquidity refers to how easily assets can be converted into cash” (Mueller, 2019). Cash is therefore the most liquid asset class. A person’s “net worth is calculated by subtracting all liabilities from assets. An asset is anything owned that has monetary value, while liabilities are obligations that deplete resources” (Ganti, 2019). So, the money one makes is only a component that factors into one’s wealth.

Lil Baby emphasizes that liquidity is important to him as he says “only thing I can count is the money I got.” Though there are ways to quantify the value of what he possesses (assets), the ability to have cash at his leisure is important to him. Let’s get into what that 5-year goal for Lil Baby will look like. On a consistent plan, Lil Baby would have to end each of those five years with $20 million in cash, or in the next liquid asset types like checking accounts, saving accounts, money market accounts where that money would go. However, he would have to make an excess of that would pay his taxes, living expenses through the year, and outstanding credit and debt balances or any financial obligations through the year. Once he is left with his disposable income (money left over after satisfying needs), he must have the discernment to see what he is left with, and what will best get him to that $20 million at the end of each year, if he isn’t already there. Only then, would he walk away with his $100 million.

Now that we’ve gotten a sense of the cash flow and how that applies to Lil Baby’s goals, let’s look at the other side of what he said.

“I save most of my money. I can’t buy a watch for 300 bands and then be like I got my 300 and my watch. My 300 gotta be in the bank.”

Lil Baby uses the example of a $300,000 watch. It’s admirable. Watches are one of the few luxury items that maintain or build in value. I personally love how real it is that he has the mindset that a watch doesn’t matter to him as much if he doesn’t have the amount that the watch itself cost on him or in his account. It is an approach that financial advisors look for in a client because their client is realistic and able to be definitive about their finances and decisions on them. It demonstrates a readiness — for an opportunity to grow or plan for an emergency. We’ve all seen how unpredictable life can be this year and years prior. Either way, to see financial goals met, you must make them and then plan for them. The right mindset will help.

Lil Baby has shown, when you make it a clear defined goal to save, you prioritize and value your possessions and time differently. This is what I learned in a year working as an associate financial advisor at Northwestern Mutual, working with some of New York’s top insurance and investment professionals on Park Avenue. Here are couple of other key things that seasoned advisors taught me when dealing with a potential client who’s interested in investing:

- Every decision you make with your money is an investment

- Your spending (outflow, allocation) of money is a direct reflection of your lifestyle and what is important to you

- We as humans spend our money on things we need or want. Categorizing our needs and wants can be hard if not viewed objectively

- The more you observe every expense or investment, you’ll begin to give purpose to each use of your dollar

2. Your goals and finances correlate to each other — plan for both

- For every goal you have, there is likely some financial implication to it. If you hope to be promoted in 2 years, there’s a salary increase that should be associated. If your aim is to buy a house in 5 years, there’s a down payment and other associated costs you will have to be able to pay to start the purchasing process at that time.

- As a goal oriented person, one should understand to make the goal happen, there are steps in between your start and finish. Financial planning is the same way. Consistency is key.

3. There’s no action to be taken without disposable income when it comes to financial planning

- It can be more harmful than helpful to have someone invest when they have no room for error — in this case financial error. One bad market week or month could cause a dip without room can’t recover from, making a year or 5 of planning meaningless

- If you have no disposable income, your first priority should be one of two things — (1) to increase your income stream or (2) decrease or cut down on your spending

4. A savings account should serve two purposes — emergency and opportunity

- An account that is easily accessible without any penalties for withdrawal (very liquid)

- If you have little to nothing saved or leftover after your expenses are paid, how can you be prepared for an opportunity to purchase land, a car, take a vacation, or any opportunity you’d like without regretting after

- Emergencies can come out of nowhere. Unless you have some risk management tools or systems in place for yourself, how would you take care of yourself or something else if your income sources went dry or you’re no longer able to work.

5. The Principle of Suitability

- Your financial solutions and goals are yours and not someone else’s

- Your plan has to be tailored to you, your goals, and your reality

With artists like Lil Baby, 21 Savage and more providing the culture with financial bars, we see there is a common theme of black wealth. The theme of Black History Month this year is The Black Family; Representation, Identity and Diversity and we want to continue to educate our people on how we can begin to gain economic power and rebuild our communities using our platforms. Especially today, it is vital to have a financial plan to not only build wealth but to pass down the knowledge as well. Be sure to follow us on Instagram The Black Currency as we highlight and celebrate Black History month.

Written by: Rodney Green